Interesting attachment for those who are financially inclined to get a better perspective on the world’s economies

We know the world’s richest man is Carlos Slim Helu of Mexico,

followed by Bill Gates and Warren Buffet of USA .

How about governments?

Which countries’ government is the richest (having most money that is, in US $)

If you are expecting North American and European nations, you might be disappointed.

While the countries look rich, wealthy European nations can’t withstand a prolonged major financial crisis, just like Greece .

The USA might have the biggest economy, but the American government is not at all rich; in fact, it can’t even take out $150bn if asked to without resorting to borrowing.

To date the US government has borrowed $14 trillion!

The UK , likewise, while the country/people are rich, the government isn’t.

The UK government’s debt stands at $9 trillion now.

World’s Richest Government

Richest governments after 2008-2009 financial crisis:

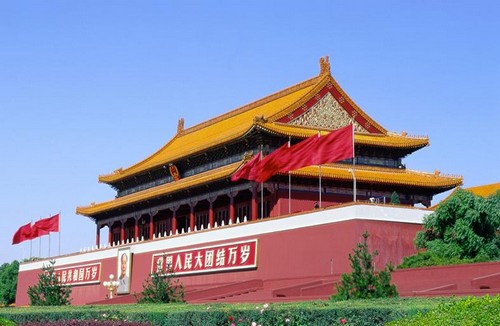

1. China

National reserves: $2,454,300 Million.

National reserves: $2,454,300 Million.

3. Russia

3. RussiaNational reserves: $458,020 Million.

4. Saudi Arabia

4. Saudi ArabiaNational reserves: $395,467 Million.

5. Taiwan

5. TaiwanNational reserves: $362,380 Million.

6. India

6. IndiaNational reserves: $279,422 Million.

7. South Korea

National reserves: $274,220 Million.

National reserves: $274,220 Million.

011 Singapore / 203,436

012 Germany / 189,100

013 Thailand / 150,000

014 Algeria / 149,000

015 France / 140,848

016 Italy / 133,104

017 United States / 124,176

018 Mexico / 100,096

019 Iran / 96,560

020 Malaysia / 96,100

021 Poland / 85,232

022 Libya / 79,000

023 Denmark / 76,315

024 Turkey / 71,859

025 Indonesia / 69,730

026 United Kingdom / 69,091

027 Israel / 62,490

028 Canada / 57,392

029 Norway / 49,223

030 Iraq / 48,779

031 Argentina / 48,778

032 Philippines / 47,650

033 Sweden / 46,631

034 United Arab Emirates / 45,000

035 Hungary / 44,591

036 Romania / 44,056

037 Nigeria / 40,480

038 Czech Republic / 40,151

039 Australia / 39,454

040 Lebanon / 38,600

041 Netherlands / 38,372

042 South Africa / 38,283

043 Peru / 37,108

044 Egypt / 35,223

045 Venezuela / 31,925

046 Ukraine / 28,837

047 Spain / 28,195

048 Colombia / 25,141

049 Chile / 24,921

050 Belgium / 24,130

051 Brunei / 22,000

052 Morocco / 21,873

053 Vietnam / 17,500

054 Macau / 18,730

055 Kazakhstan / 27,549

056 Kuwait / 19,420

057 Angola / 19,400

058 Austria / 18,079

059 Serbia / 17,357

060 Pakistan / 16,770

061 New Zealand / 16,570

062 Bulgaria / 16,497

063 Ireland / 16,229

063 Portugal / 16,254

064 Croatia / 13,720

065 Jordan / 12,180

066 Finland / 11,085

067 Bangladesh / 10,550

068 Botswana / 10,000

069 Tunisia / 9,709

070 Azerbaijan / 9,316

071 Bolivia / 8,585

072 Trinidad and Tobago / 8,100

073 Yemen / 7,400

074 Uruguay / 8,104

075 Oman / 7,004

076 Latvia / 6,820

077 Lithuania / 6,438

078 Qatar / 6,368

079 Cyprus / 6,176

080 Belarus / 6,074

081 Syria / 6,039

082 Uzbekistan / 5,600

083 Luxembourg / 5,337

084 Guatemala / 5,496

085 Greece / 5,207

086 Bosnia and Herzegovina / 5,151

087 Cuba / 4,247

088 Costa Rica / 4,113

089 Equatorial Guinea / 3,928

090 Ecuador / 3,913

091 Iceland / 3,823

092 Paraguay / 3,731

093 Turkmenistan / 3,644

094 Estonia / 3,583

095 Malta / 3,522

096 Myanmar / 3,500

097 Bahrain / 3,474

098 Kenya / 3,260

099 Ghana / 2,837

100 El Salvador / 2,845

101 Sri Lanka / 2,600

102 Cambodia / 2,522

103 Côte d’Ivoire / 2,500

104 Tanzania / 2,441

105 Cameroon / 2,341

106 Macedonia / 2,243

107 Dominican Republic / 2,223

108 Papua New Guinea / 2,193

109 Honduras / 2,083

110 Armenia / 1,848

111 Slovakia / 1,809

112 Mauritius / 1,772

113 Albania / 1,615

114 Kyrgyzstan / 1,559

115 Jamaica / 1,490

116 Mozambique / 1,470

117 Gabon / 1,459

118 Senegal / 1,350

119 Georgia / 1,300

120 Panama / 1,260

121 Sudan / 1,245

122 Zimbabwe / 1,222

123 Slovenia / 1,105

124 Moldova / 1,102

125 Zambia / 1,100

126 Nicaragua / 1,496

127 Mongolia / 1,000

128 Chad / 997

129 Burkina Faso / 897

130 Lesotho / 889

131 Ethiopia / 840

132 Benin / 825

133 Namibia / 750

134 Madagascar / 745

135 Barbados / 620

136 Laos / 514

137 Rwanda / 511

138 Swaziland / 395

139 Togo / 363

140 Cape Verde / 344

141 Tajikistan / 301

142 Guyana / 292

143 Haiti / 221

144 Belize / 150

145 Vanuatu / 149

146 Malawi / 140

147 Gambia / 120

148 Guinea / 119

149 Burundi / 118

150 Seychelles / 118

151 Samoa / 70

152 Tonga / 55

153 Liberia / 49

154 Congo / 36

155 São Tomé and Príncipe / 36

156 Eritrea / 22

Big national reserves doesn’t guarantee prosperity however, for instance, the yearly expenses for China ‘s government is $1.11 trillion, their government must always think of economic growth and making more money.

China’s gov’t overspent $110bn last year, much on it towards modernizing their military, if it goes on like this their reserves can only last for 22 yrs.

The Malaysian gov’t overspent $13bn last year, if it goes on like this their reserves can only last for 7 yrs.

The Singaporean government overspent $3bn last year, much of it rescuing their banks from financial crisis, if it goes on like this their reserves can last 68 yrs.

The Swiss gov’t overspent $1bn last year, if it goes on like this their reserves can last 262 yrs.

A country normally can borrow up to 100% its GDP, a very strong industrial country or very financial stable nation can borrow up to perhaps 200% its GDP, debts over 250% GDP the country is bankrupted.

Greece ‘s Debts Is 113.40% GDP, In Danger As It Is Not Considered A Strong Industrial Or Financial Country.

Iceland Is 107.60%, Also In Crisis As It Is Not So Strong Industrial Or Financially.

Singapore Debts Is 113.10%, Not In Hot Water Due To Its Global Financial Hub Status, And Also Its Financial Strength. It’s Only Dangerous For Singapore When It Reaches 200%

Japan Debts Is 189.30%, Still Under Radar As A Powerful Industrial Nation. It Needs To Panic Only At Around 200%

US Has The World Largest Debts, But It Is Only 62% Its GDP, It Is Not In Any Immediate Danger Of Bankruptcy.

Zimbabwe Debts Is 282.60% GDP, It Is A Bankrupted Nation.

Malaysia Debts Is Currently At 53.70% GDP.

Hong Kong And Taiwan Is Doing Pretty Good With Debts At 32-37% GDP

South Korea Is Even Better With Debts At 23.5% GDP

China Is Very Stable With Debts At 16.90% GDP

Russia Is Like A Big Mountain With Debts Only At 6.30% GDP

There Are Only 5 Countries With No Debt (I.E. 0%) –

Brunei, Liechtenstein , Palau , Nieu, And Macau Of China